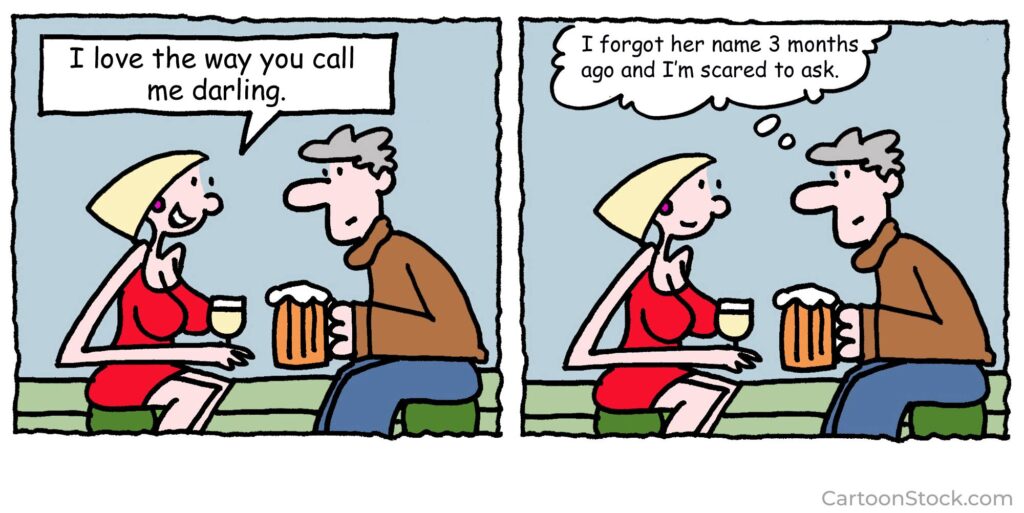

An important part of all close, intimate relationships is the mutual sharing of terms of endearment.

Terms of endearment are spoken words, often accompanied by body language, that communicate love, affection, appreciation, commitment, and value. These expressions don’t take a long time to convey, yet they are very impactful. Without them, a relationship can become stale, disconnected, or insecure.

I often approach my 10-year old grandson and say “Benjamin, you’re such a wonderful boy and I love you so much. I think about you throughout the day.” And then I kiss him on the forehead.

I’ll say to my wife, “Mary, I love so much, and I’m glad we have each other. You’re a wonderful wife, mother, and grandmother.” Followed by a warm embrace.

I’m quite sure my father loved me, but he never told me. And he never said things like, “Don, I’m proud of you. I love you very much”. Also lacking were physical expressions – hugs, a pat on the back, a kiss on the forehead.

Examine your close relationships. Are moments of tender expression missing? Are you generous with sharing terms of endearment or are they few and far between? It’s never too late to change. It may feel awkward at first, but the more you do it, the easier it gets.

If you’re in a leadership position, don’t neglect speaking words of affirmation and support to team members. Phrases like, “I really appreciate your hard work. You are so good at what you do. Your people skills are superb. I totally trust your judgment.” can be life-giving to people in your organization.

Almost all human relationships can benefit from terms of endearment. They are also an important part of our relationship with God. He says to us, “I will never leave you or forsake you. I love you with an everlasting love. My future plans for you are all good.” We should reciprocate by expressing to Him our adoration and praise. You can create your own phrases or recite phrases from poets and lyricists. Hymns such as My Jesus I Love Thee, Fairest Lord Jesus, and Jesus, the Very Thought of Thee are replete with meaningful phrases.

Let’s get good at this. I can’t think of any downside.